Emergency Savings

Posted On: November 19, 2025 by San Luis Valley Federal Bank in: Financial Education

Sticking to a routine savings plan has never been easy. It’s even more difficult when something unexpected happens, like an accident or a natural disaster. Many consumers use credit cards or loans as a quick solution during emergency situations.

Unfortunately, high-interest debts can be hard to pay off. If you don’t pay off those balances regularly, you can pay more in the long run through accrued interest. If you fall...

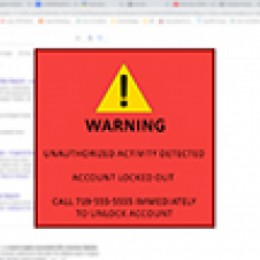

6 Common Scams

Posted On: October 30, 2025 by San Luis Valley Federal Bank in: Financial Education

Most of the time, poorly formed scams are easy to spot. However, there could be times when you second guess your intuition and follow through with the scammer's requests, which ends in a disaster. Never assume a scam won't happen to you; scammers are becoming increasingly clever.

The quickest way to spot a scam is how they prefer to collect payment. Gift cards are becoming the preferred payment method. It is a scam if they ask for payments through gift cards. Gift...

Credit Report Opt Out

Posted On: August 20, 2025 by San Luis Valley Federal Bank in: Financial Education

We recently learned that some members receive many marketing solicitations after pulling their credit report. The four major credit bureaus, Equifax, Experian, Innovis, and Transunion, have made purchasing your credit inquiry data much easier. It is important to note that credit inquiry data is NOT the same as your credit report.

San Luis Valley Federal Bank nor any other bank or finance company control solicitations you...

Raising Financially Responsible Children

Posted On: August 19, 2025 by San Luis Valley Federal Bank in: Financial Education

Did you know that setting up a savings account for your children can be the best way to get them started on healthy and successful money habits? On the surface, it teaches basic math skills, but more importantly, it encourages long-term thinking and planning, which helps children become more goal-oriented. Also, it helps children better understand the value of money. The best way to encourage saving is to help them set a realistic goal and make it fun!...

Money Mule Scams

Posted On: September 27, 2024 by San Luis Valley Federal Bank in: Financial Education

When criminals obtain money illegally, they need to hide or launder the source of the funds. One method they use is to look for people to transfer that money for them. Those people become money mules, and are used to move and launder the money.

If someone sends you money and asks you to send some or all of it to someone else, you could be a money mule. Often, scammers will approach you online, but they may also call you directly. Regardless of the particular...

Financial Trauma

Posted On: March 1, 2024 by San Luis Valley Federal Bank in: Financial Education

In the realm of financial education, there exists a subject rarely discussed: financial trauma. Yet, despite its taboo nature, its impact reverberates through countless lives, often quietly shaping financial behaviors and attitudes.

However, recognizing and addressing financial trauma isn't always met with open arms. Some may view it as an unnecessary intrusion into personal matters or dismiss...

Health Savings Accounts

Posted On: September 29, 2023 by San Luis Valley Federal Bank in: Financial Education

In today's ever-changing healthcare industry, one tool that has emerged as a powerful ally for those seeking to take control of their medical expenses while building financial security is Health Savings Accounts (HSAs). If you're enrolled in a high deductible health plan (HDHP), an HSA can be a game-changer, offering a blend of tax advantages and savings opportunities. At San Luis Valley Federal Bank, we understand the significance of HSA accounts...

Protecting your Business

Posted On: July 7, 2023 by San Luis Valley Federal Bank in: Financial Education

What is Business Identity Theft?

In the case of a business, a criminal takes over the identity of a business and uses that identity to establish lines of credit with banks or retailers. Using this credit, the identity thief purchases goods, gift cards, and other items that can be bought and exchanged for cash, or sold with relative ease.

The damage can be devastating to the business and to the...

Safe Banking for Seniors

Posted On: June 15, 2023 by San Luis Valley Federal Bank in: Financial Education

We are joining the American Bankers Association Foundation’s Safe Banking for Seniors campaign. We will mobilize bankers across the Valley to educate older Americans, their caregivers, and other family members about identifying and preventing elder financial exploitation.

Financial Health

Posted On: January 20, 2023 by San Luis Valley Federal Bank in: Financial Education

Your credit report is your most important financial document. It’s what’s used by lenders to determine if you’re eligible for a loan, and it may also be checked when you apply for a job, insurance, or to rent a property.

The information on your credit report is used to calculate your credit score. If you want to increase your score, you need to make sure that the information the credit bureaus are collecting...