Posted On: August 19, 2025 by San Luis Valley Federal Bank in: Financial Education

Raising Financially Responsible Children

Did you know that setting up a savings account for your children can be the best way to get them started on healthy and successful money habits? On the surface, it teaches basic math skills, but more importantly, it encourages long-term thinking and planning, which helps children become more goal-oriented. Also, it helps children better understand the value of money. The best way to encourage saving is to help them set a realistic goal and make it fun! We have provided a few talking points to get your children on the path to saving.

Talking Points for Parents

-

Start Early

-

Make a Plan

-

Lead by Example

-

Set Goals and Explain Delayed Gratification

-

Encourage Earning and Saving

-

Discuss the Benefits of Saving

-

Help Them Open a Savings Account

-

Be Patient and Let Them Make Mistakes

Start Early

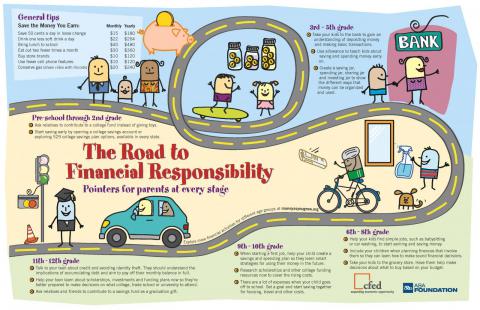

The earlier you start teaching your children about saving money, the better. Even young children can understand the concept of saving money and develop good saving habits. Help your children get familiar with numbers. Teach them the concepts of bigger/smaller and more/less, and help them understand how lower prices allow them to buy more.

Make a Plan

Help your child create a plan for saving money, plus make it fun. It could include setting a savings goal, a timeline for achieving it and identifying ways to cut back on spending. Use games and other activities to help them learn. Create a positive experience to help encourage saving!

Lead by Example

Children learn best by watching their parents, so ensure you are modeling good financial habits. Talk to your child about how you save money and the importance of being financially responsible. It's important to meet children at an age-appropriate level and be strategic in your approach. Make sure to use language that they can easily understand. Take advantage of the natural opportunities that happen throughout your daily life.

Set Goals & Explain Delayed Gratification

Explain to your child that saving money means waiting to buy something they want instead of buying it right away. Have them create goals to help them stay on track to save money. Help them set short-term goals and long-term goals. The first step is to start saving, which is to put money aside regularly and watch it grow.

Encourage Earning & Saving

Encourage your children to earn money. They can do chores, babysit, or start a small business. Most importantly, they learn the value of hard work. Early experiences with budgeting, saving, and managing money can become lifelong habits, and it’s never too early to build one. Empower your kids to practice money management with their own checking and savings accounts and help them create healthy habits that will bring lifelong benefits.

Discuss the Benefits of Saving

Teach your children the importance of a budget and how to stick to it. They learn to manage their money wisely and avoid overspending. Talk to your children about needs versus wants. To build a lifetime habit of saving, it’s critical to learn the importance of maintaining and growing a savings account at an early age. Help your kids identify their financial goals and teach them to save up as early as possible for various purposes: for larger purchases, emergency funds, and even retirement.

Help Them Open a Savings Account

Consider opening a savings account that best fits your and your child's needs. Our Chipmunk Savings Account offers an interest-bearing account with a $1 minimum balance to open. With this account, you can have a secure place to deposit and save money setting your child up for a successful financial future.

Put the literacy in financial literacy.

Encourage your children to read books that cover various money concepts. Not only will they become strong readers, but they will be smart money managers, too. Click here for a list of Reading Pays book titles for all ages.

Be Patient & Let Them Make Mistakes

Be patient. Your help will teach your children how to save money and make smart financial decisions. They won't be experts overnight. Growing up is possibly the only time when anyone can make money-related mistakes without serious financial consequences. So if you don’t talk to your kids about money, you’re depriving them of precious opportunities to explore, make mistakes and learn from them. Continue to learn with your kids, so both you and they can feel comfortable and confident talking to each other.

Banking Terms

-

Budget: a plan for how you will spend your money.

-

Saving Account: interest-bearing account used to hold money for short or long-term goals or emergencies.

-

Compound Interest: interest earned on both the principal (the initial amount you deposit) and the interest you've already earned.

-

Annual Percentage Rate (APR): The interest rate and fees or additional costs you're charged yearly for a loan or credit card. As a customer, a lower rate is always better.

-

Annual Percentage Yield (APY): the effective annual rate of a return taking into account the compounding of interest on savings, checking, CD, or money market accounts. On this rate, the higher, the better.

0 comments