Posted On: February 28, 2025 by San Luis Valley Federal Bank in: News

Beware of Home Warranty Scams: Don't Let High-Pressure Tactics Fool You

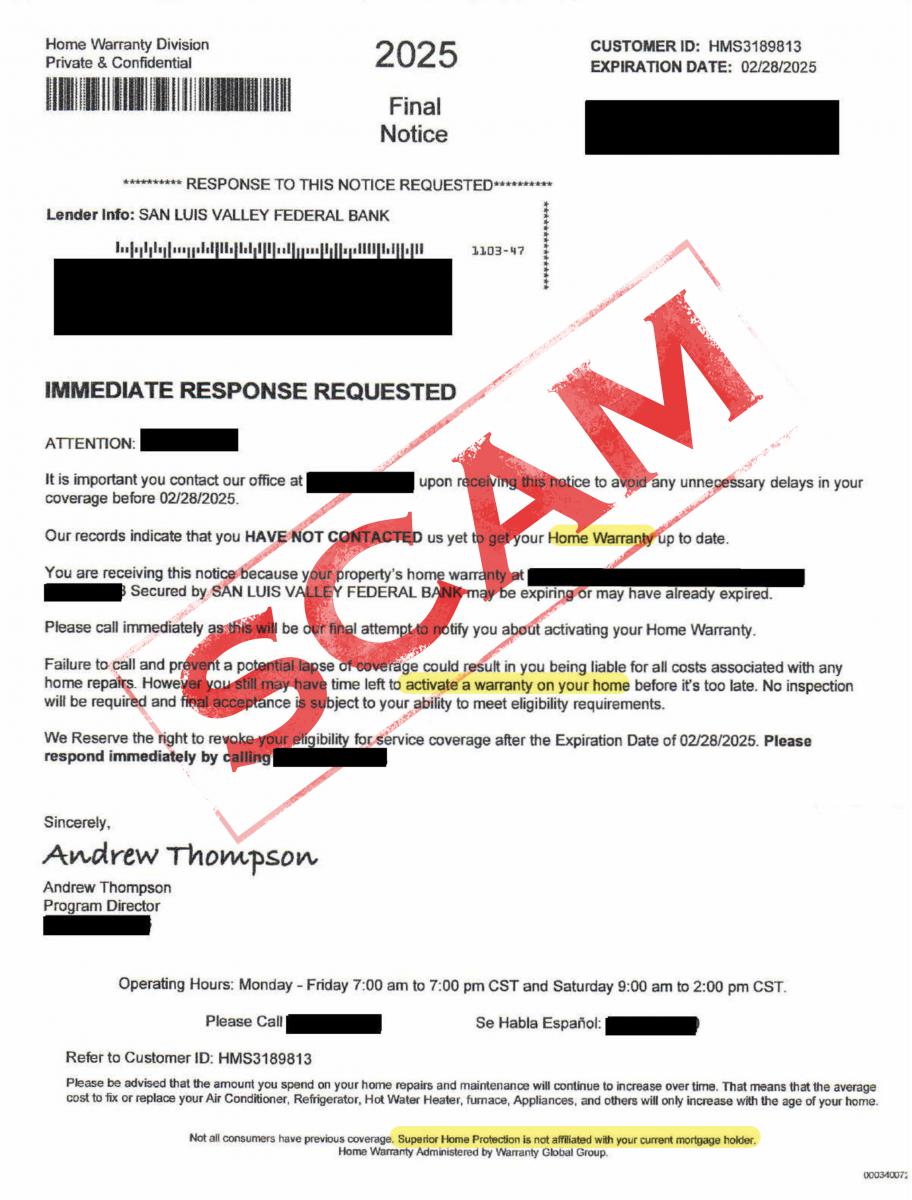

Scams are on the rise, and one of the latest tricks involves a so-called "home warranty" notice. Remember: while most homeowners have insurance for their property and separate warranties for appliances, there is no blanket "home warranty" managed by your Bank or mortgage provider. Scammers will exploit this confusion and pressure you into making hasty decisions.

How These Scams Work

Scammers will often pretend to be from a trusted organization, using names that sound official. They rely on:

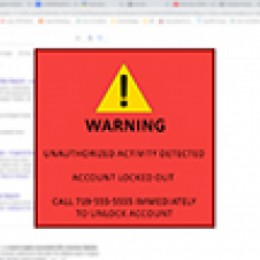

- Urgency and Pressure: Phrases like "FINAL NOTICE" and "IMMEDIATE RESPONSE REQUIRED" are designed to create panic, much like the time-sensitive decision scams we’ve warned about before. If a message pushes you to respond immediately, that’s a red flag.

- Misleading Terminology: The term “home warranty” is used to trick you. Unlike home insurance or appliance warranties, a general “home warranty” is not something your lender would enforce.

- Asking for Sensitive information: They will usually ask for sensitive information to make a payment or to settle the issue. Providing payment information, such as a credit card or bank account number, will give them access to your account, creating additional issues.

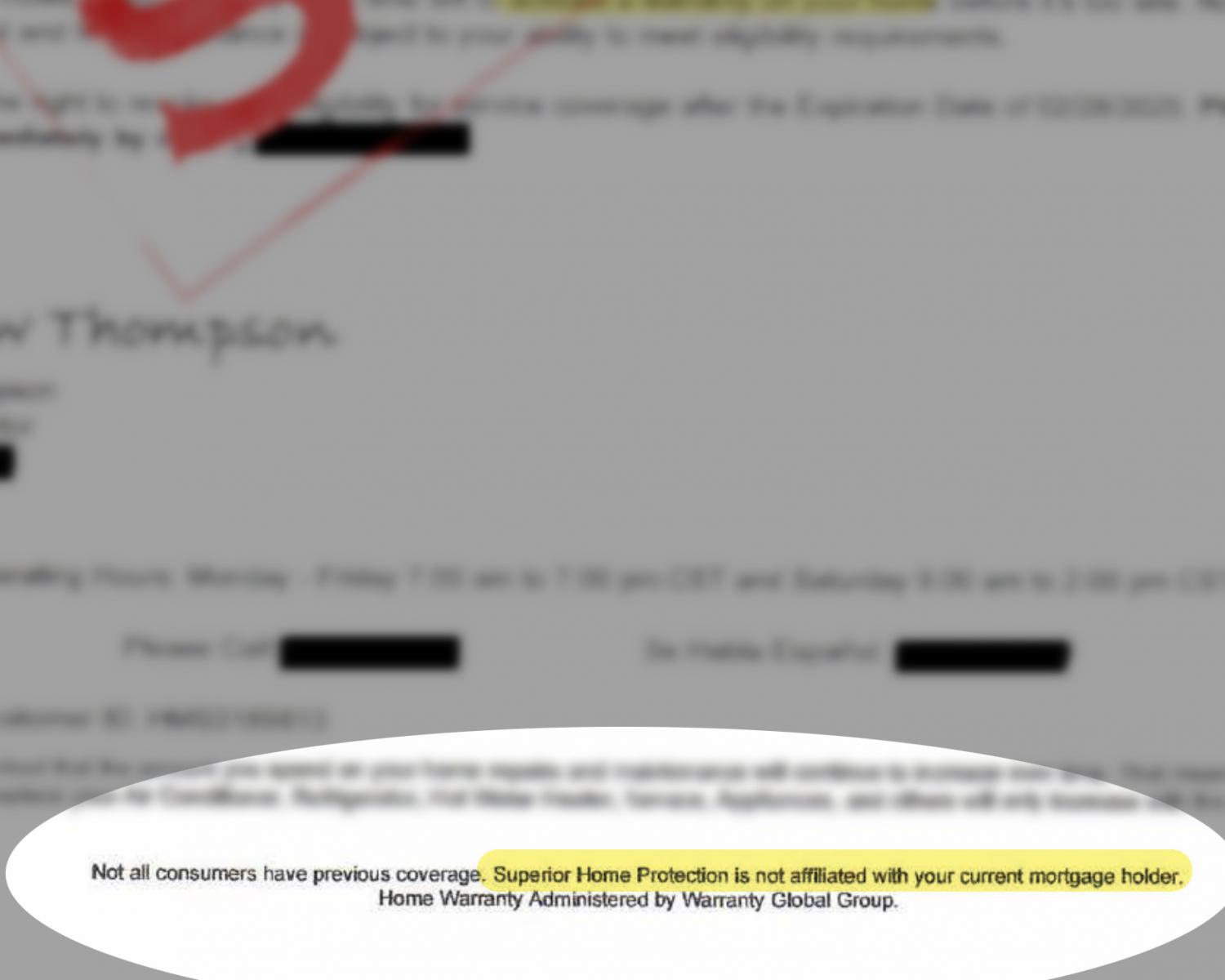

- They will hide critically important details in the letter: This particular letter has the statement "Superior home protection is not affiliated with your current mortgage holder"

What You Can Do

If you receive any suspicious communication:

- Stop and Think: If the message is unexpected, take a moment to consider its validity. Ask yourself, "Would a trusted institution really pressure me like this?"

- Verify Independently: Do not use the contact details provided in the suspicious message. Instead, look up the official phone number or website for your Bank or mortgage provider. Or go physically visit the Bank's office.

- Block and Report: It's perfectly okay to hang up, or even block the number. Reporting the scam to the proper authorities, such as the FTC at reportfraud.ftc.gov, helps protect others.

- Talk to Someone You Trust: Call someone you know at the Bank. Discuss any unusual request with a friend, family member, or neighbor. A second opinion can help you see red flags you might have missed.

You can protect your hard-earned money from scammers by staying informed and cautious. Remember, if it sounds too urgent or too good (or bad) to be true, it probably is.

Stay safe and vigilant!